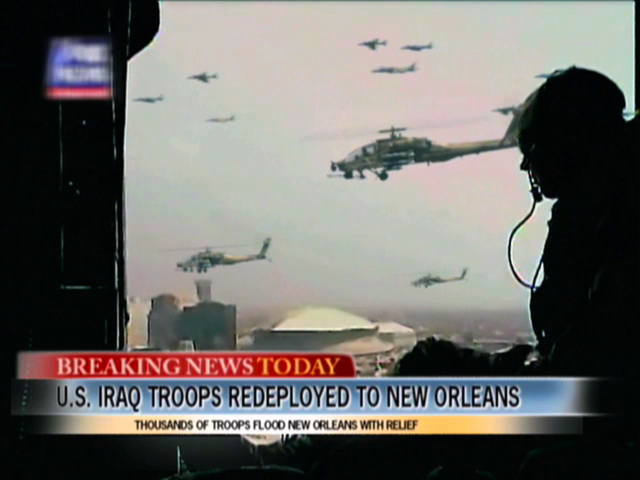

| THE SAINTS ARE COMING

I cried to my daddy on the telephone,

how long now?

Until the clouds unroll and you come home,

the line went.

But the shadows still remain since your descent,

your descent.

U2 and Green Days, The Saints are coming, September 2006

Courtesy of Daily reckoning

Gold’s trading at around $1,280 this morning. So, if you buy gold today and it goes to $5,000 an ounce or $10,000 an ounce, which I do expect, you’d probably be extremely happy.

But that doesn’t tell the whole story. Gold will have increased dramatically in nominal terms. If gold goes from $1,000 an ounce to $5,000 an ounce, most people would say that’s a 400% increase in the price of gold.

But it’s really an 80% devaluation of the dollar. That 80% dollar devaluation leads to a world of $5,000 gold. But it also leads to a world of $400 per barrel and $10.00 gas.

Yes, you need to own gold in that situation because you’ll be protected against inflation. You’ll be in a far better position than those who don’t. They’ll be wiped out. But in many ways you’re just keeping up, since everything you buy will be much higher.

The key takeaway is that a higher dollar price for gold is just a lower value for the dollar. And that’s what the elite’s want.

It’s part of their global inflation plan…

How do you get all the major economies in the world to create inflation without relying on destructive currency wars that merely shuffle money around between winners and losers?

The answer is very interesting. It’s a two-part answer, really. And they’re both coming. You could call it a master plan for global inflation…

I explained yesterday how the monetary elites are looking to engineer higher gold prices to generate inflation since nothing else has worked. That’s the first answer. The evidence is very strong for that hypothesis.

The second part of the answer goes by the name of helicopter money. You’ve probably heard all about it. Helicopter money is different than QE, quantitative easing. It conjures up the image of a helicopter dropping money onto the streets below. Everyone picks up the money, runs down to Walmart and goes on a buying spree. All that extra spending leads to inflation. That’s not literally how the process works, but the idea is the same.

Let me explain technically how helicopter money does work. It’s a combination of monetary policy and fiscal policy. The central bank controls money printing, but it can’t control government spending. That’s up to the Congress.

With helicopter money, the monetary authority and the fiscal authority work together. When Congress wants to spend a lot more money, it produces larger budget deficits. And the Treasury has to cover that deficit by issuing more bonds. The Federal Reserve buys the bonds. And it prints money to buy the bonds.

The answer still comes back to money printing. Quantitative easing, which they’ve been doing for seven years on and off is money printing, but it works differently. With quantitative easing, the Federal Reserve simply buys bonds from a bank. It pays for the bonds with printed money, which goes to the bank. What do the banks do with it? In theory, they’re supposed to lend it to businesses and private citizens.

But people have been reluctant to spend it and banks don’t want to lend it. What do the banks do with that money if there’s no lending and spending? They give it back to the Federal Reserve in the form of excess reserves. After all, the Federal Reserve is a bank. It’s a bankers bank, essentially.

What good does that do anybody? None, really. It just inflates all the balance sheets and props up the banks. It doesn’t do the economy any good.

Helicopter money is different because Congress spends the money. Helicopter money doesn’t give the money directly to people because they might not spend it. But the government will. The government is very good at spending money.

The Democrats prefer benefit programs, welfare programs, social spending, education, healthcare, and the like. The Republicans prefer defense, intelligence, corporate subsidies, and so on.

The way Democrats and Republicans usually compromise on these things is to do both. Everybody gets something. They can build six new aircraft carriers, offer free tuition, free healthcare, free housing, etc.

Then the supposed Keynesian multiplier kicks in to increase consumer spending. The Keynesian multiplier says that if the government spends money to hire people to build a highway, for example, they’ll spend it by going to dinner, the movie theater, buying new cars, vacations, etc. And those on the receiving end of that money spend it on other things, in a virtuous cycle.

But the Keynesian multiplier might not be nearly as effective as elites suspect. With an economy saturated in debt like ours, you reach the point of diminishing returns. (By the way, if helicopter money fails, plan B is to increase the price of gold, as I explained yesterday. That works every time).

The leader on this is House Speaker, Paul Ryan. Last December, Sir Paul Ryan passed Obama’s budget and busted the ceiling caps that have been in place since 2011. The Ryan budget of September 2015 busted the cap. (It also refinanced the IMF, which was buried in a 2012 bill, but that’s a story for another day).

But that budget bill was the tip of the iceberg. The plan now is to have much larger budget deficits. The point is, if people won’t spend, the government will. When the government spends and deficit finances it, it will eventually produce inflation. |